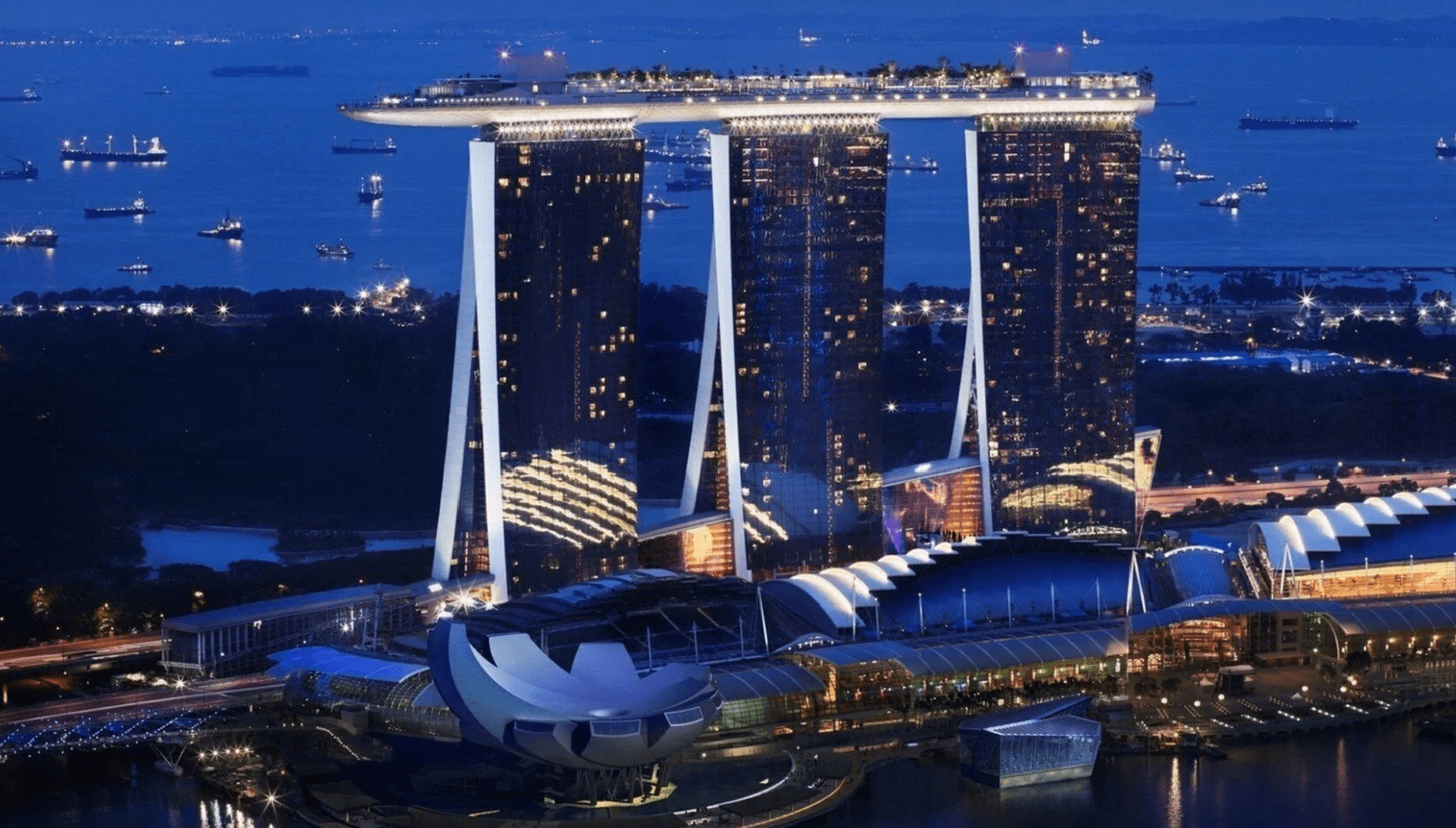

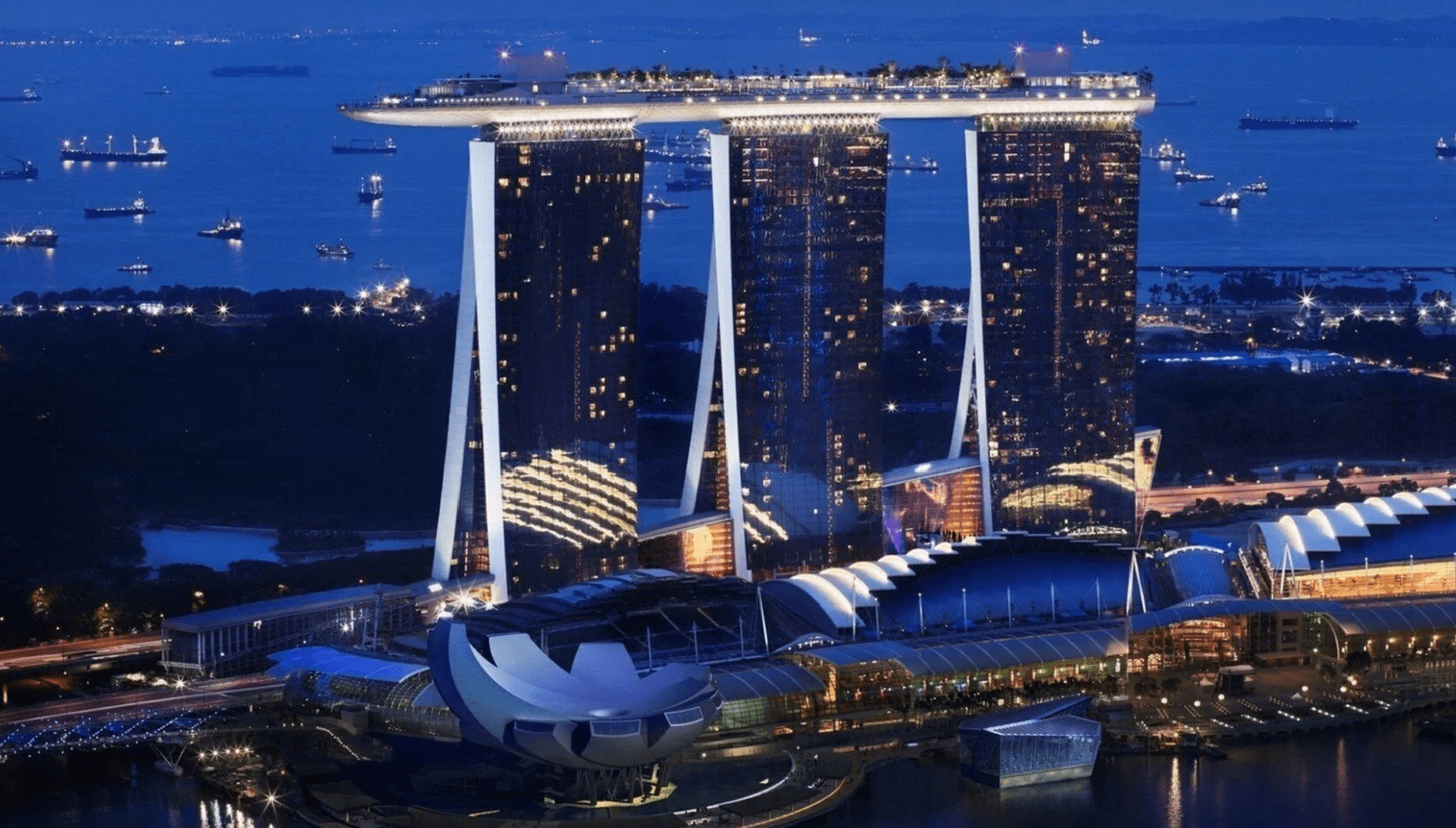

In July 2025, Las Vegas Sands (NYSE: LVS) will begin work on its $3.3 billion expansion of Marina Bay Sands in Singapore after announcing the acquisition of a fresh $1.5 billion credit revolver.

Following Moody's Investors Service's earlier this week expressed worry that the gaming company's plans to repurchase its own shares and pay dividends could act as a roadblock to a higher credit rating, the credit facility announcement was made. Nevertheless, the revolver, granted by Bank of Nova Scotia, indicates that Sands can access financial markets and that lenders are willing to provide credit to the massive casino operator.

"The loans made under the Revolving Credit Agreement will bear interest at either, at the Borrower’s option, (x) an adjusted rate equal to the secured overnight financing rate as administered by the Federal Reserve Bank of New York (or a successor administrator of the secured overnight financing rate), plus an applicable margin ranging from 1.125% to 1.550% per annum, or (y) at an alternate base rate, plus an applicable margin ranging from 0.125% to 0.550% per annum, in each case, depending on the Borrower’s corporate family credit rating,” according to a Sands Form 8-K filing with the Securities and Exchange Commission (SEC).

According to market capitalization, LVS is the biggest gaming firm. Moody's has given it a "Baa3" rating and a "stable" outlook.

Being Sands' only location outside of Macau, Marina Bay Sands—one of just two integrated resorts in Singapore—is essential to mitigating some of the risks involved with doing business in China.

In addition to being a lucrative casino resort and one of the most valuable gaming brands globally, these facts further establish Sands' position as the portfolio's jewel and a key component of the company's broader investment strategy.

The company that constructed the original property, Safdie Architects, will build a fourth tower as part of the $3.3 billion extension project at MBS. With a goal to complete the expansion by July 2029, Sands plans to begin building in July 2025.

"The new all-suite hotel tower will raise the bar for hospitality, the cutting-edge arena will draw the best performers and events from around the world, and the expanded convention and exhibition space will further cement Singapore's position as a top MICE destination," said Sands CFO Patrick Dumont in a statement. "This major investment in Singapore will help guarantee that Marina Bay Sands is in a prime position to increase its contributions to the economy, jobs, and tourism in the years to come."

The aforementioned Marina Bay Sands expansion is not included in the operator's current $1.75 billion proposal for the existing building.

Data demonstrates that Sands' long-term investments in the Singapore venue have benefited both the operator and its investors.

“Since opening in 2010 at a development cost of $5.6 billion, Marina Bay Sands has provided significant benefits to Singapore’s tourism sector, with over 470 million people having visited the resort since its opening. The resort has also meaningfully contributed to the business tourism appeal of Singapore, having hosted more than 1,750 new-to-Singapore MICE events since the opening of Marina Bay Sands,” according to the statement.

As the 2024 election approaches, Missouri voters are inundated with advertisements for gaming campaigns. In addition to selecting the next presiden .. Read more

In what now seems to be a sequence of impeccably timed acquisitions, Tilman Fertitta increased his holding in Wynn Resorts (NASDAQ: WYNN), raising his .. Read more

This week, authorities were searching for a wheelchair-bound man who pilfered $5,000 in cash. The treasure was lying on the Rivers Casino Pittsburgh f .. Read more

© TheRealGamble, 2026. All rights reserved