An investor can purchase two shares in Melco Resorts & Entertainment (NASDAQ: MLCO) for less than what, in some areas of the United States, is the price of a Big Mac. That is to say, the casino operator is inexpensive in terms of price.

It is so inexpensive that it is listed among the top 10 stocks trading for less than $10 on Morningstar's most current list, which was just released. Lawrence Ho's gaming company is currently trading for about $8.30, which is less than some people's daily Starbucks bill.

The reason for the low price is that Ho's wealth dropped by 33.3% in the last year, which knocked him off Forbes' list of the richest individuals. But the chief executive officer of Melco is still a billionaire, so don't cry for him.

Nevertheless, Ho and the other Melco investors have been hurting for some time. The stock began trading at about $20 in mid-April 2021 and fell as low as $4.85 on July 15, 2022.

To be fair, among Macau casino equities, Melco is not the lone underperformer. The group had a very poor performance in 2018. This pushed values to points where some observers claimed they reflected disastrous occurrences like the beginning of the coronavirus epidemic and the global financial crisis.

Credible value names and inexpensive equities are really different from one another. The fact that some market watchers think the gaming stock is a value option could help Melco's cause. According to Morningstar, the stock is undervalued by almost 32%, with a market value of $12.60. Melco would have to increase by more than 50% from its current levels in order to get that price. Since May 2023, it hasn't closed above $12.60.

"We believe the gambling market in Macao will enjoy solid growth in the longer term,” notes Morningstar analyst Jennifer Song. “This structural tailwind is driven by the rising middle class in China and the penetration rate of less than 2% in Macao, compared with Las Vegas’ 13%. New hotel rooms by major operators in the next few years should accommodate increased and extended visits from bigger spenders from these provinces, and drive the top line for integrated resort operators.”

Melco is the company that runs Studio City, Altira, Morpheus, and City of Dreams in Macau. In Manila and Cyprus, the business also operates casino hotels under the City of Dreams name.

Melco shares may rise since nongaming revenue in Macau is getting close to 2019 levels and gross gaming revenue (GGR) is expected to reach or surpass pre-pandemic highs this year.

"As one of only six concession holders to operate casinos in Macao, Melco Resorts & Entertainment is ideally placed to benefit from this market dynamic, given its portfolio of properties catering to both mass-market and premium patrons,” added Song. “We expect the launch of Studio City phase 2 with 900 luxury rooms in 2023 to be the next profit driver.”

Melco's exposure to mass and premium-mass clientele, according to Song, reduces the volatility that comes with VIP clients, a market that is currently having trouble in Macau due to past junket industry scandals.

The Cedar Rapids casino initiative, which was approved by the Iowa Racing and Gaming Commission just last week, now has a scheduled opening date. Pe .. Read more

A shooting early Saturday morning at WinStar World Casino and Resort in Thankerville, Okla. resulted in one fatality. The Love County Sheriff’s Of .. Read more

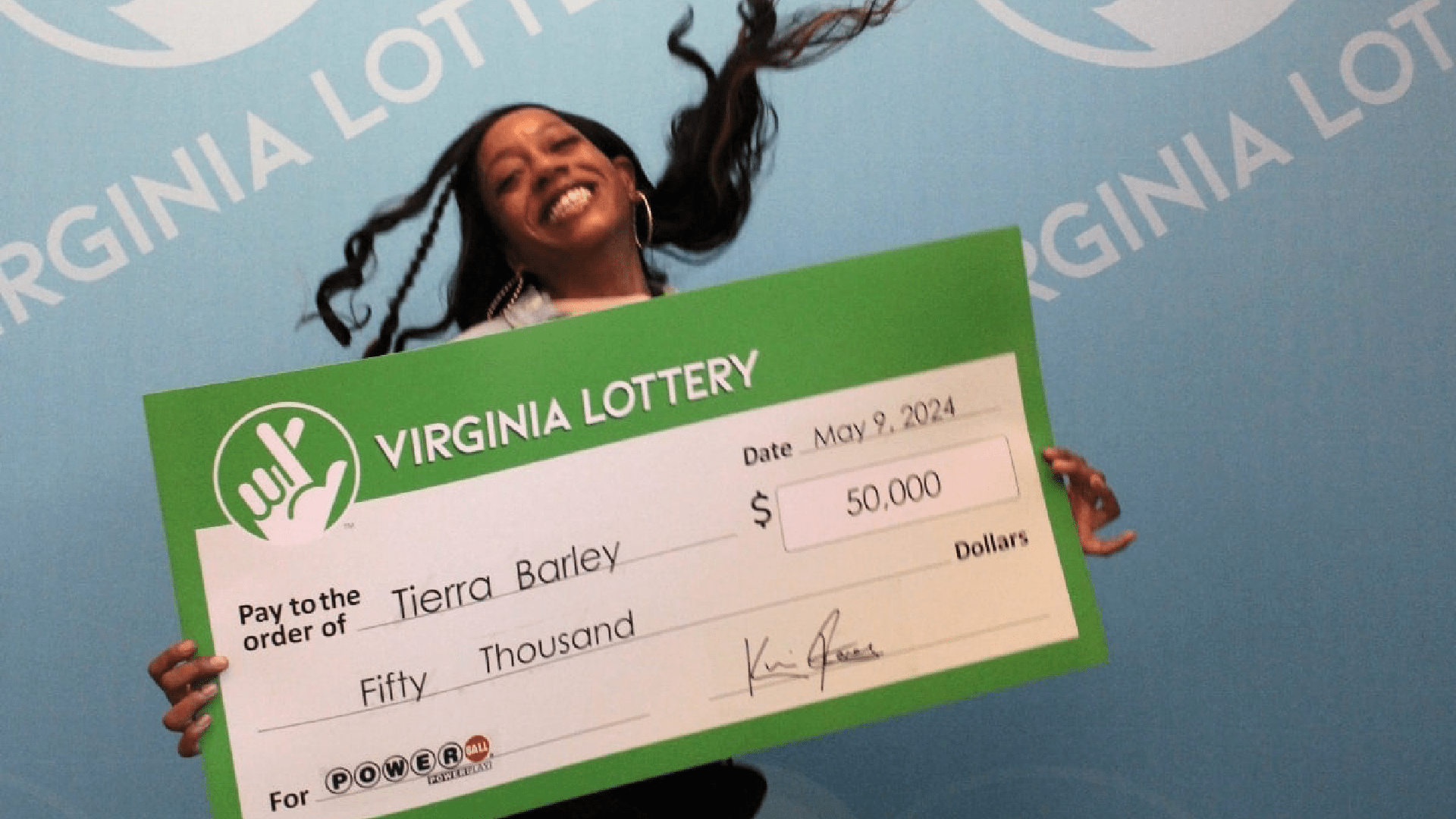

Numerous individuals break open the fortune cookie included with their Chinese food takeout and enjoy the crunchy, sweet wafer, but for one fortunate .. Read more

© TheRealGamble, 2026. All rights reserved