Shares of Star Entertainment Group dropped to a new all-time low on Thursday as the Australian casino operator encounters a liquidity shortage and a crisis of trust among its lenders.

In a report released on Thursday, Morningstar analyst Angus Hewitt mentioned that Star possesses $AU79 million in cash as of the end of 2024, a decrease from $AU107 million at the conclusion of the third quarter. With that rate of expenditure, the gaming "would be fortunate to reach its interim results on February 28, 2025, without assistance." The gaming firm is facing challenges in accessing a credit facility that might sustain its operations.

"Star is struggling to fulfill conditions to unlock the second AUD 100 million tranche of its debt facility. This includes additional subordinated capital of at least AUD 150 million, likely to be equity,” said Hewitt.

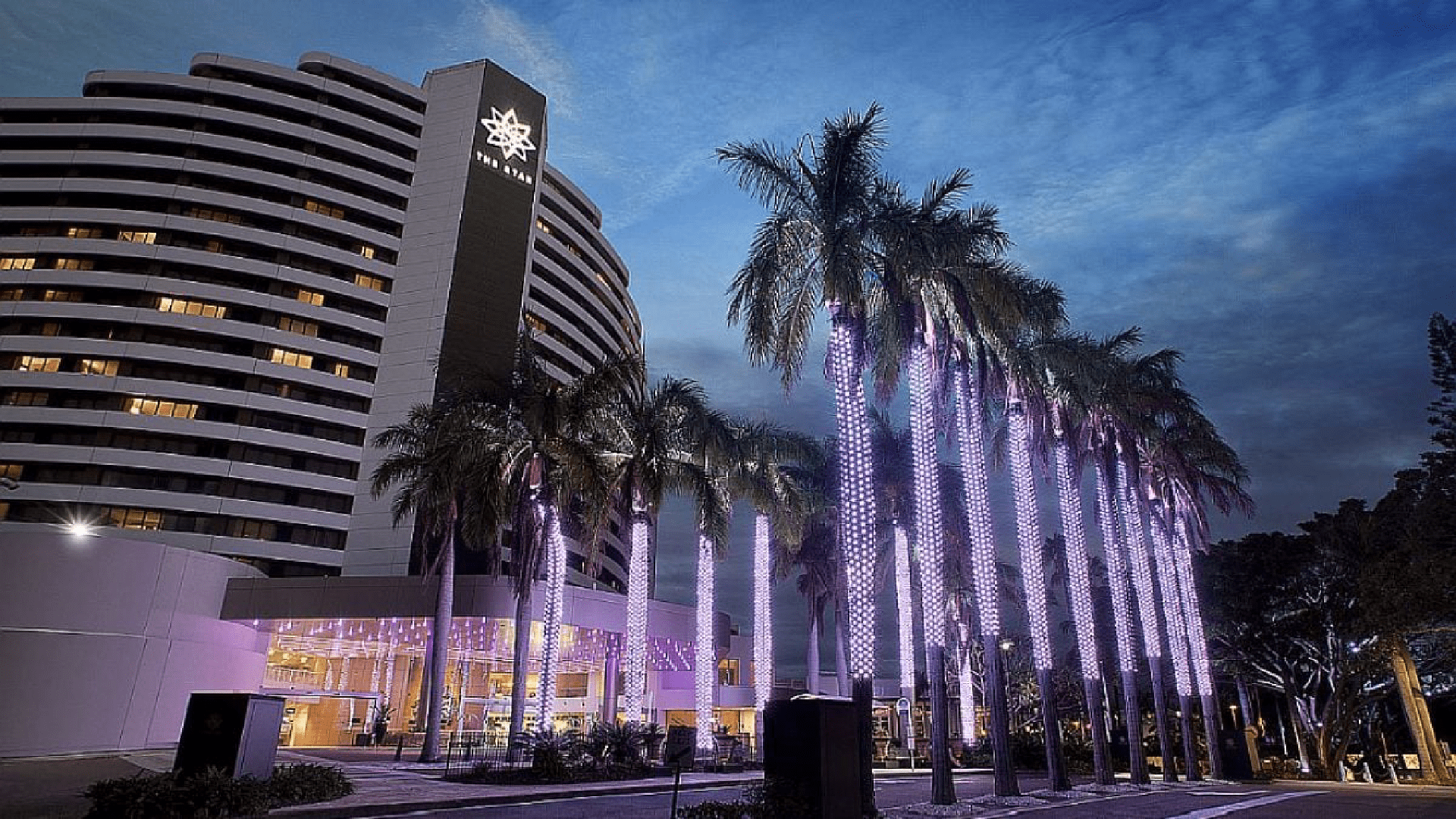

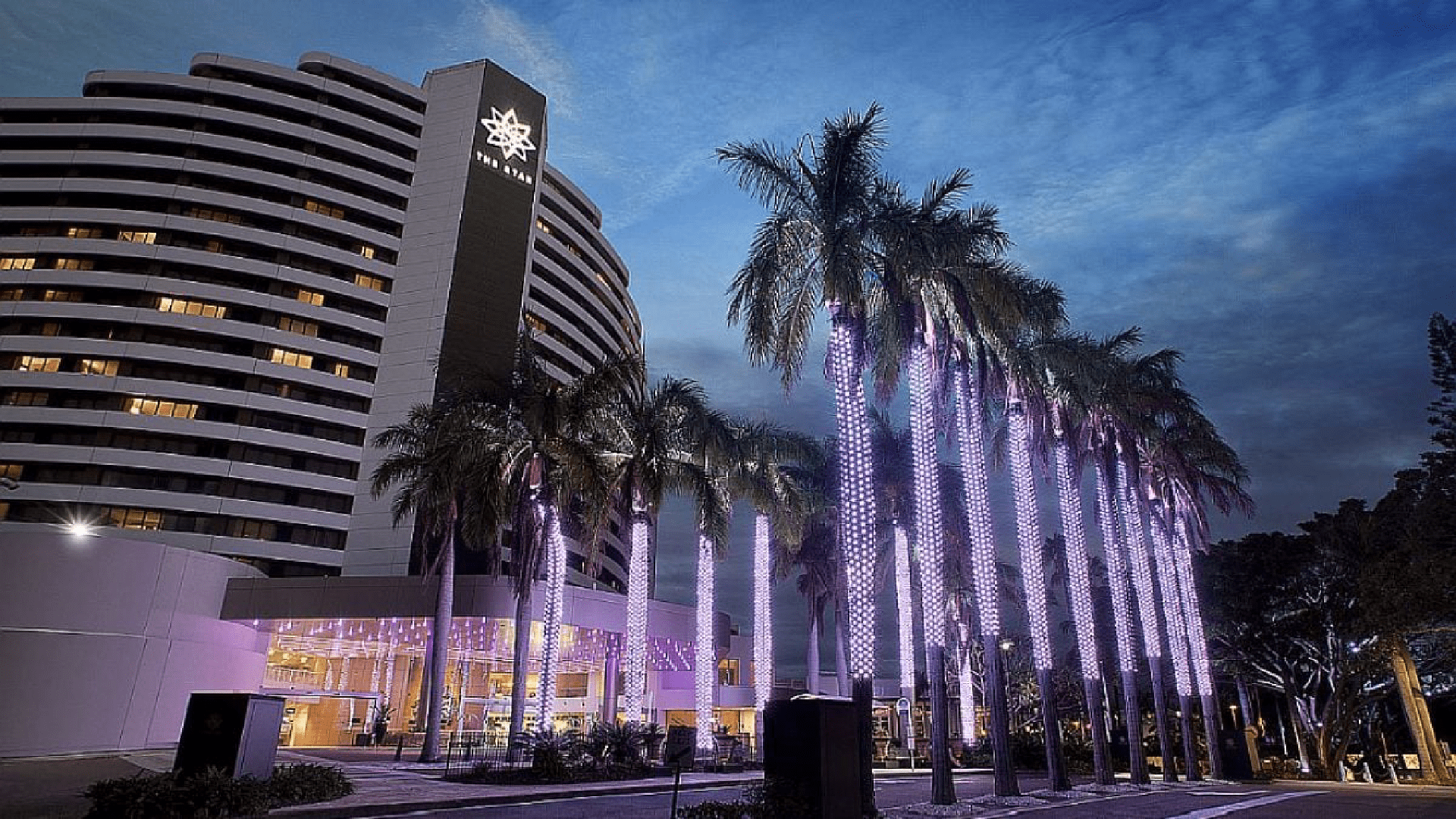

In the midst of an extensive anti-money laundering investigation, Star faces the potential loss of control over its main site, The Star Sydney. The Australian government has operated that venue since 2022. The government's management extends to Star's additional locations, The Star Brisbane and the Star Gold Coast. That inquiry, along with poor macroeconomic conditions, has placed the casino operator in a situation that some analysts consider unsustainable.

Reports of Star’s tightened liquidity came to light roughly two weeks after it was disclosed that US banking powerhouse JPMorgan Chase & Co. (NYSE: JPM) sold off its 5.47% stake in the gaming firm’s voting shares.

“Star has other potential lifelines, including selling individual assets or finding a potential suitor. We still expect a medium-term recovery in operating conditions for casinos,” adds Hewitt. “However, Star needs a more immediate solution, and we believe it is unlikely it can trade itself out of this predicament.”

Certain analysts think that as the company nears potential administration, which could make it essentially a government responsibility, locating a buyer may prove challenging and that rescuers are probably not forthcoming in the short term.

Adding to the challenge of locating a possible candidate are the factors of a sluggish Australian economy and poor carded performance at Star properties.

Due to lenders' concerns over its shrinking cash reserves, Star might be prohibited from issuing debt and may need to contemplate selling equity, which would additionally impact the already low share price.

"We continue to expect Star to raise AUD 150 million in equity to draw on the second tranche. We now assume a dilutive raise of AUD 0.10 per share from AUD 0.20 previously. This is a discount of about 30% to where Star’s shares trade,” observes Hewitt.

The analyst assigns an “extreme uncertainty” rating to the stock, targeting a price of $AU 0.20, while acknowledging a 50% likelihood that Star enters administration.

Near Penn State University's main campus in State College, Pennsylvania, a new school is about to open. Later this year, students will start learning .. Read more

The Cherokee Nation of Oklahoma, through its business subsidiaries Cherokee Nation Businesses (CNB) and Cherokee Nation Entertainment, LLC, has reques .. Read more

The NFL and ESPN have reached an agreement wherein the sports network will purchase the NFL Network along with other league-owned media properties, in .. Read more

© TheRealGamble, 2026. All rights reserved