Plans to expand Hudson Yards on Manhattan's West Side for $12 billion were recently revealed by Related Companies. The projected casino hotel by Wynn Resorts (NASDAQ: WYNN) would cost $5.7 billion of that total.

That is, if the operator is able to secure one of the three downstate casino licenses that New York state authorities have not yet granted. The $12 billion price tag is far more than the $10 billion that was previously estimated to be the project's possible cost at Hudson Yards. Privately held Related has stated that without a gaming license, it most likely won't proceed with the project.

"Although the total development cost for the Western Hudson Rail Yards complex may be as high as $12 billion, as recently reported, the development cost for the Wynn New York City gaming resort is approximately $5.7 billion, excluding licensing fees and financing costs,” according to a statement issued to Casino.org by Michael Weaver, chief communications and brand officer at Wynn.

The Hudson Yards expansion would feature 1,500 apartments, a public school, a daycare facility, and two million square feet of office space in addition to the casino.

Weaver pointed out that funding and licensing are not included in the projected $5.7 billion cost of a Wynn casino in New York City.

In reference to the latter matter, it was first thought that New York would demand that successful bidders pay $500 million in upfront license fees. However, there is conjecture circulating that the licensing fees may increase to $1 billion for each winning operator due to the state's financial difficulties.

If Wynn is granted a casino permit in New York, it may theoretically have to pay $6.7 billion in expenses before financing costs. That is a sizeable portion of the operator's $10.98 billion market capitalization as of Tuesday's closure on U.S. markets.

There is a view in the gaming industry that New York City has the ability to raise licensing fees since it may be the best untapped domestic casino prospect.

Weaver's statement made no mention of Wynn's intention to borrow money to construct in New York, should it be granted one of the three casino licenses. It might be costly for the operator to take that route, should the necessity arise.

Despite growing optimism from credit rating agencies for the gaming industry, Wynn continues to receive subpar marks. It becomes obvious that any noninvestment-grade issuer would be compelled to tack on large coupon payments to freshly issued bonds in order to move that paper, especially when you combine that with growing rumors that interest rates may remain higher for longer.

By year's end, Wynn had $2.88 billion in cash on hand and $736.5 million available on a Wynn Resorts Finance revolving credit line.

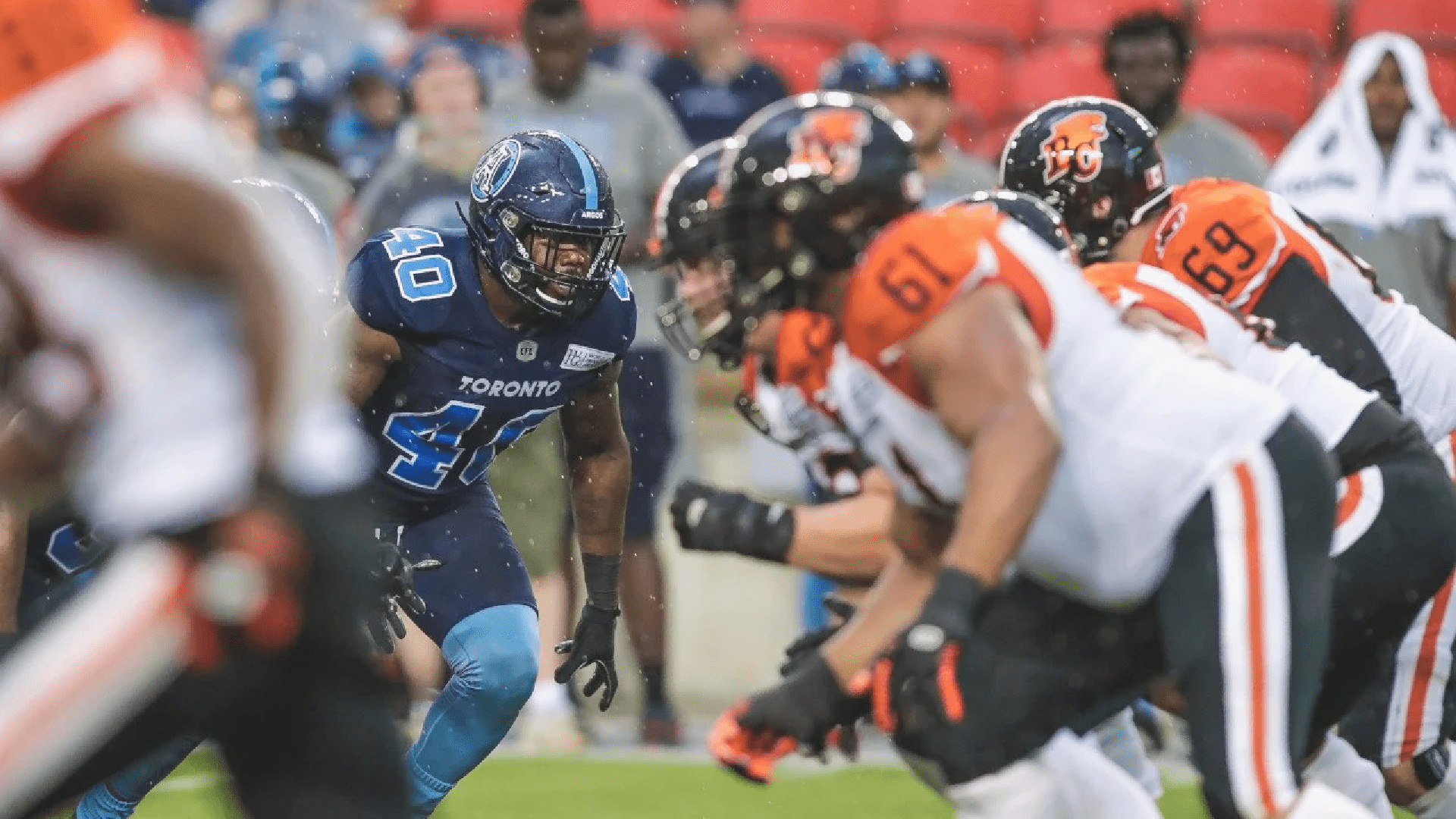

Defensive lineman Shawn Lemon has been reinstated by the Canadian Football League following his indefinite suspension in April 2024 for betting on CFL .. Read more

Operator of cryptocurrency casinos MyPrize announced on Tuesday that it has raised $13 million in two rounds of funding, increasing its enterprise val .. Read more

In what now seems to be a sequence of impeccably timed acquisitions, Tilman Fertitta increased his holding in Wynn Resorts (NASDAQ: WYNN), raising his .. Read more

© TheRealGamble, 2026. All rights reserved