When you consider that the S&P 500 has increased by 29.2% over the same period, the 19.6% decline in Caesars Entertainment (NASDAQ: CZR) shares over the last year is disheartening.

Executives at the gaming company, however, have amassed more shares by taking advantage of the slump in their employer's stock. That may be a positive indication because, according to a recent analysis by the Citi equity research team, insider purchasing and selling for the year 2024 is less than it was the previous year.

Over the last six months, insiders at Caesars have purchased 0.007% of the gaming company's shares, representing a portion of the operator's market capitalization. Based on that metric, that gambling giant was ranked in the top 20 stocks.

"Interestingly, both (buying and selling) have had some relationship to index level forward performance historically,” Citi Strategist Scott Chronert wrote in a note. Over “the last ten years there was a decent +0.51 correlation between the number of insider buyers and 12-month forward returns.”

Because insider buyers are making these purchases only because they think the value of their employer's shares will increase, insider buying can be a meaningful signal.

Caesars, which ranks 15th on the Citi list, is the only gambling business to make it into the top 20, according to the percentage of market value purchased criteria.

It may come as a relief or surprise to learn that no gaming companies were listed in the top 20 for insider sales during the previous six months. Given that insider selling of at least one well-known gaming firm was boosted, that would come as a mild shock to some market watchers.

This may prove relevant because insider selling may indicate management confidence in a stock, and because there is a small positive association between insider selling and share appreciation.

Chronert continued, "With regard to the quantity of insider sales, there is some indication that their timing is excellent, but the correlation is weaker at -0.17." "When combined, the insider buying measure is given greater weight, resulting in a mixed signal that generally suggests lower but positive expectations for future returns."

These purchases may turn out to be prophetic, suggesting that regular investors should follow the lead set by the executives who are purchasing Caesar's shares. According to several analysts, the stock has been penalized excessively, especially considering that Nevada's gross gaming revenue (GGR) continuously approaches or surpasses record levels.

Twelve of the sixteen sell-side analysts that have covered the gaming stock rate it as a "strong buy" or "buy," and the $60.13 consensus price objective indicates a 44.4% increase from the stock's present levels.

The Flamingo operator is also reducing debt, which may improve free cash flow and strengthen the stock's thesis.

Executives at Red Rock Resorts (NASDAQ: RRR) think that the proposed no tax on tips policy from the 2024 presidential campaign could potentially boost .. Read more

As the 2024 election approaches, Missouri voters are inundated with advertisements for gaming campaigns. In addition to selecting the next presiden .. Read more

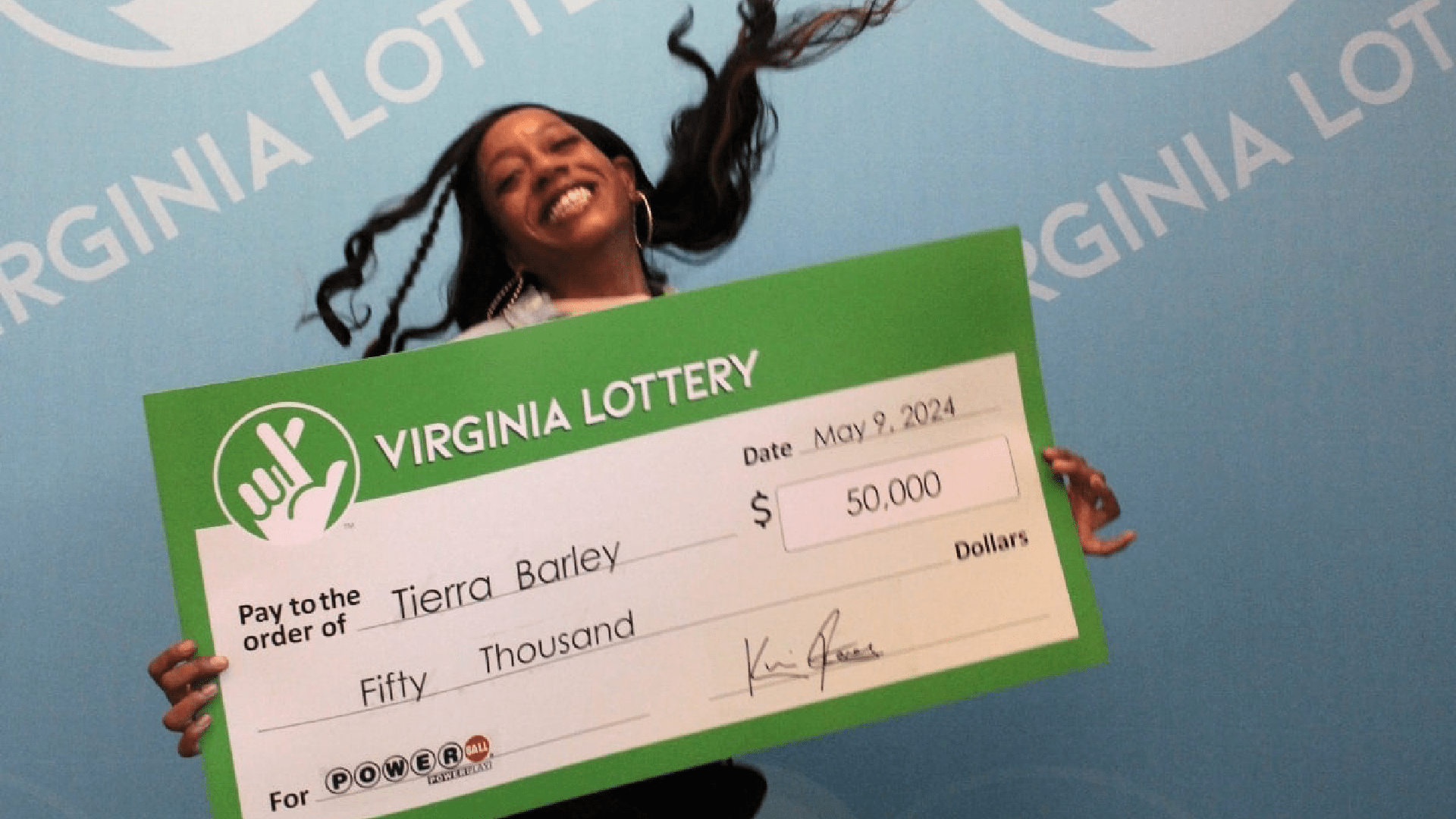

Numerous individuals break open the fortune cookie included with their Chinese food takeout and enjoy the crunchy, sweet wafer, but for one fortunate .. Read more

© TheRealGamble, 2026. All rights reserved