Brazil created legal standards for its online gambling market last year; this step is anticipated to draw some of the major firms in the sector to the greatest economies in Latin America.

Rumor has it that US-based sportsbooks titans DraftKings (NASDAQ: DKNG), MGM Resorts International (NYSE: MGM), and Hard Rock International are looking into ways to go into the region's most populous nation.

A who's who of the gaming world can be found on the nearly 135 pre-registrants list for Brazilian online wagering permits. US-based companies like Bally's (NYSE: BALY), DraftKings, and MGM are among the many others, as are organizations connected to the major European sportsbook companies Entain and Flutter Entertainment (NYSE: FLUT).

Brazil's appeal to indigenous iGaming and sportsbook operators is understandable. The US legalization process at the state level is stalling, with many people thinking it would take years for Texas and California to allow mobile sports betting. On the other hand, Brazil, the sixth-largest nation in the world, has the necessary framework in place and is home to over 209 million people.

As Brazil liberalizes its online gambling sector, Rush Street Interactive (NYSE: RSI), which is already reported to be a takeover target, may attract further attention from possible suitors.

The logic is straightforward. It's commonly assumed that when granting licenses, Brazilian regulators will favor domestic businesses and those with a strong presence in Latin America. The only US-based gaming company that ticks the latter criterion is Rush Street Interactive, which operates sports betting operations in both Mexico and Colombia.

Talk has also surfaced about the operator perhaps reaching Peru and Argentina in the future. If RSI is successful in obtaining a license from Brazil, that may make the company a desirable target for another US-based operator who perceives opportunities in Latin America.

Bloomberg revealed last month that RSI had contacted many potential purchasers, including DraftKings; however, the company has not yet made any official confirmation of these discussions.

Brazil is attractive to gaming firms due to its big economy and population, but the country's history goes deeper than that.

There aren't any land-based casinos in the nation that resemble those in Las Vegas, and there are no signs that this will change anytime soon, thus iGaming may become popular with Brazilian bettors who want access to table games.

Regarding sports betting, Brazil is renowned for being among the world's most passionate soccer fans. It is the only nation to have participated in all 21 World Cup editions, and it has numerous other records, including games played, wins, and goals scored. It has also won five World Cup crowns.

There, too, the NFL is growing in popularity, and in 2024 Sao Paulo will play host to the league's first game in South America. The citizens of the tenth-largest economy in the world also enjoy watching the NBA.

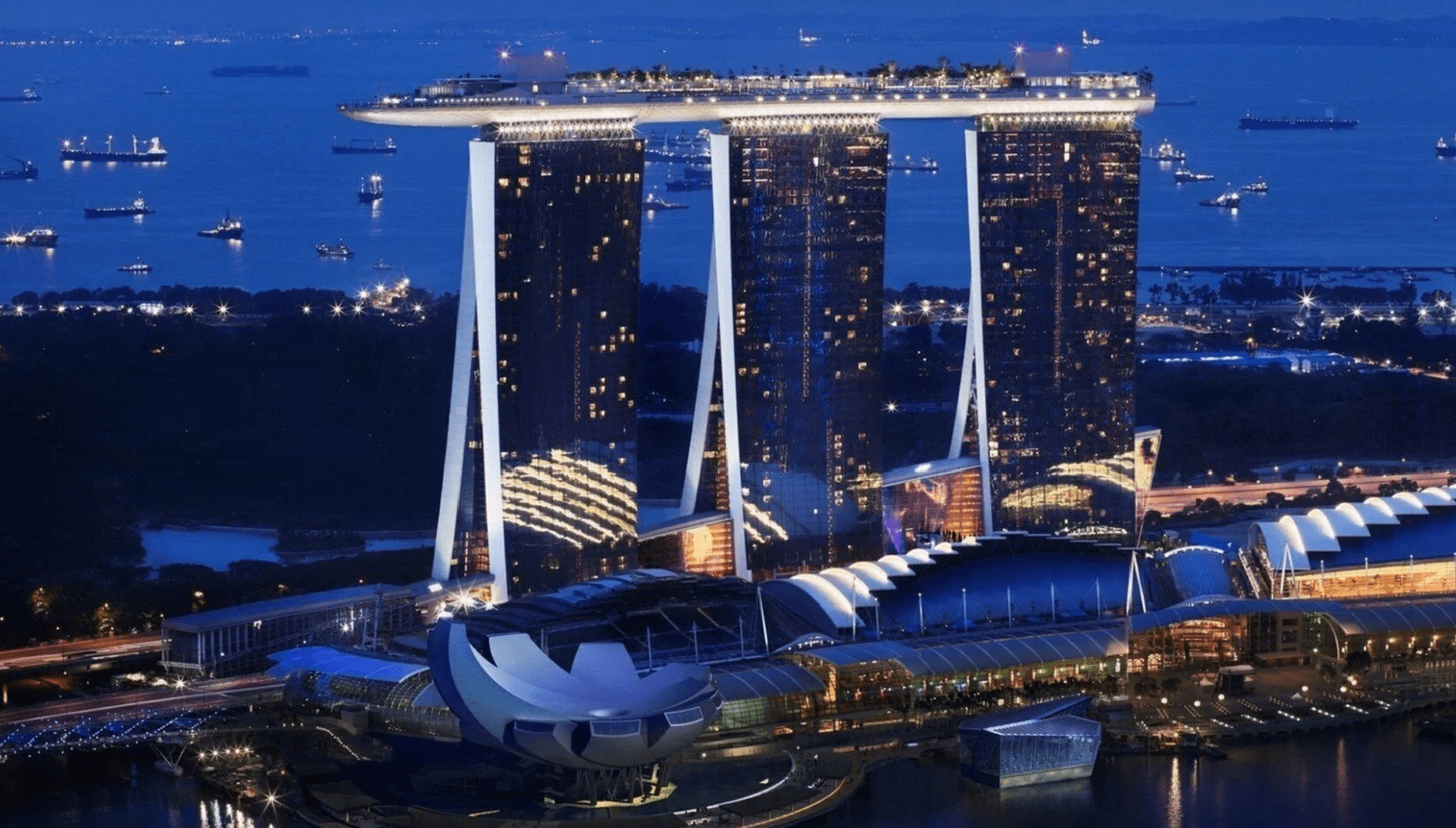

In July 2025, Las Vegas Sands (NYSE: LVS) will begin work on its $3.3 billion expansion of Marina Bay Sands in Singapore after announcing the acquisit .. Read more

On Tinian Island, a $130 million "Titanic-themed resort and casino" did not do as well as the ship that served as its model. The Titanic, at least, .. Read more

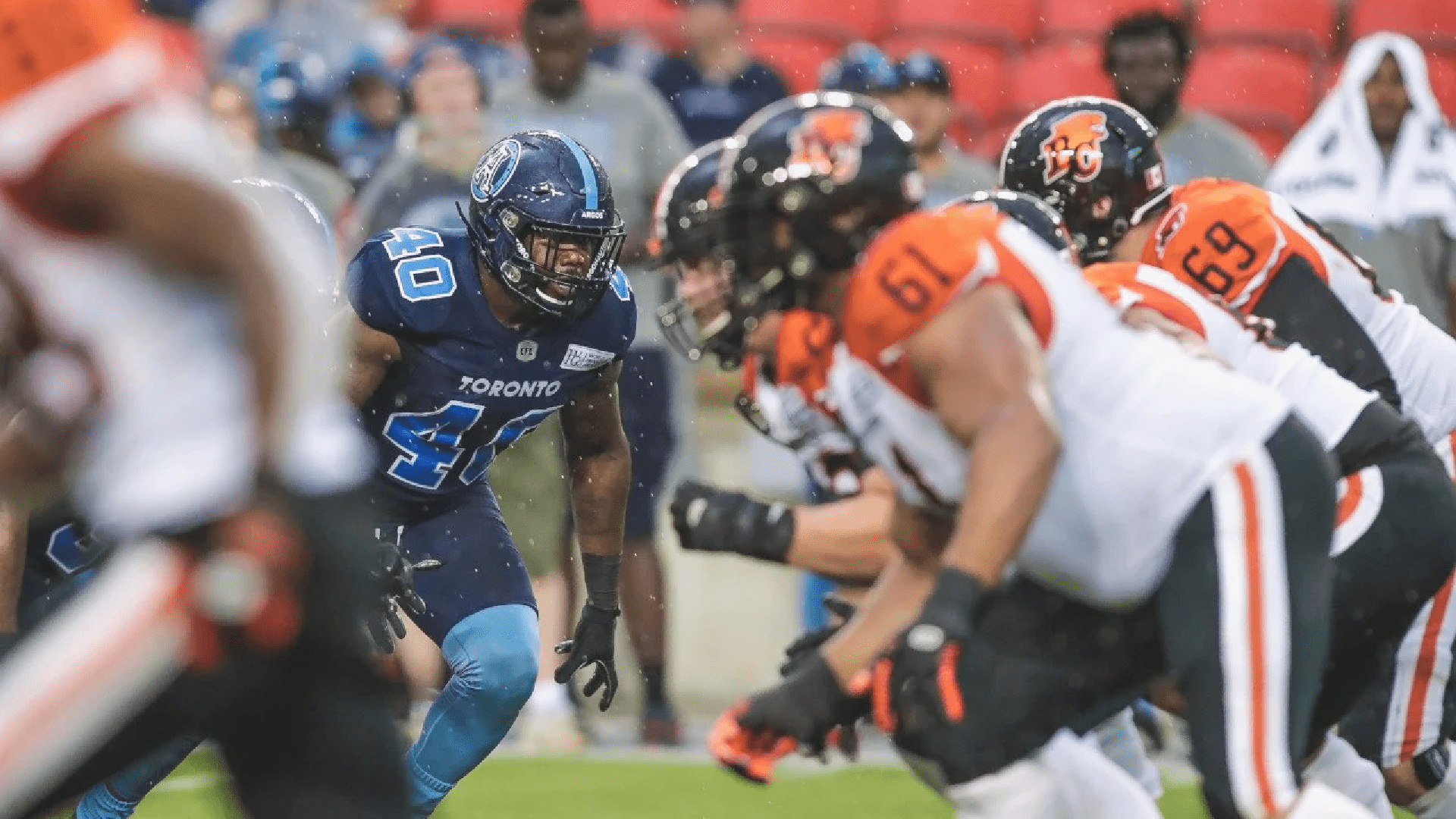

Defensive lineman Shawn Lemon has been reinstated by the Canadian Football League following his indefinite suspension in April 2024 for betting on CFL .. Read more

© TheRealGamble, 2026. All rights reserved