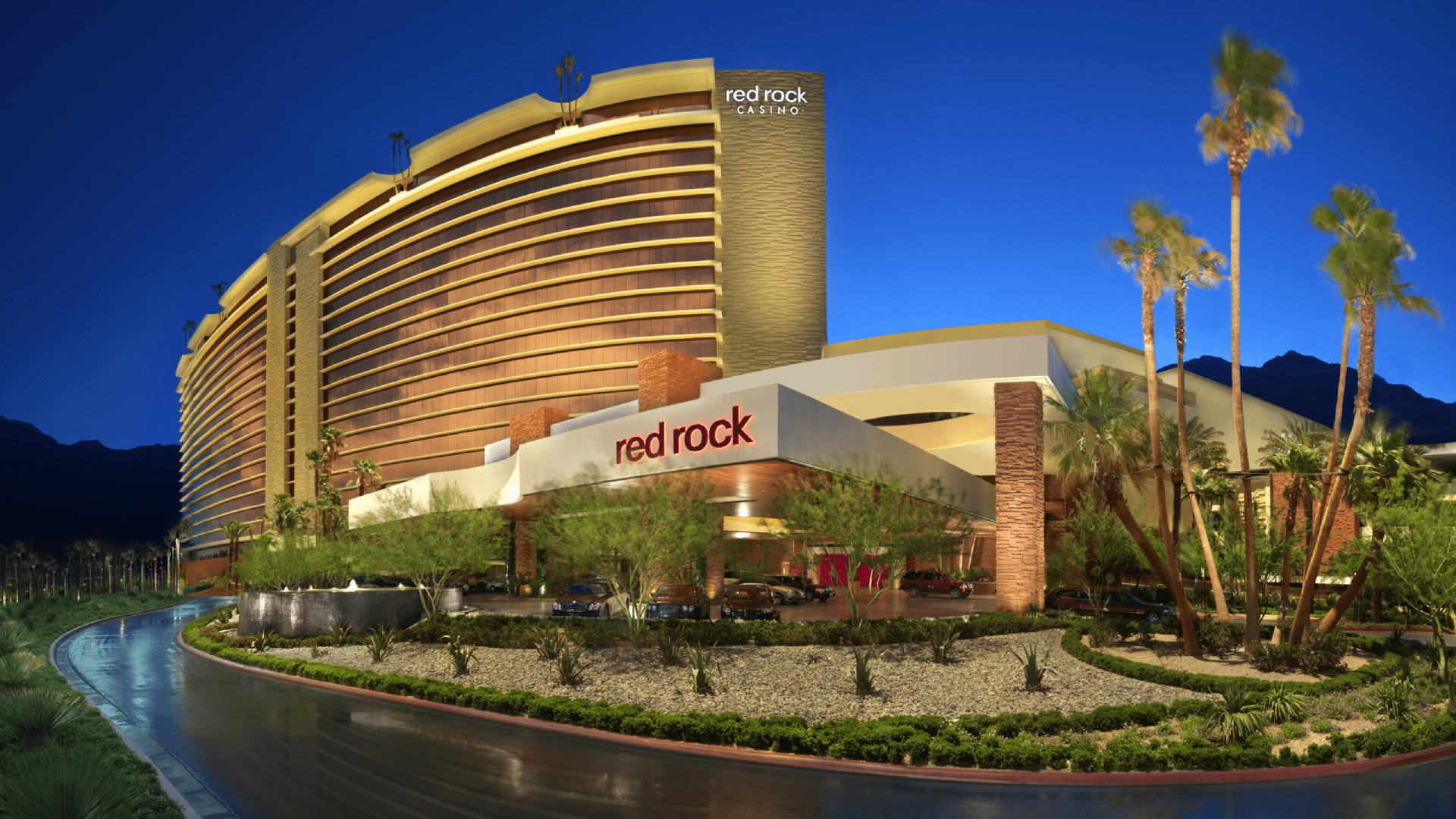

Executives at Red Rock Resorts (NASDAQ: RRR) think that the proposed no tax on tips policy from the 2024 presidential campaign could potentially boost the Las Vegas economy by around $200 million.

That concept was first proposed by President-elect Donald Trump and subsequently adopted by his Democratic rival, Vice President Kamala Harris. The proposal could have been the driving force behind Trump’s victory in Nevada, making him the first Republican presidential candidate to achieve this in twenty years. He secured the state by 3.1%, which is close to 47,000 votes, based on data from NBC News.

"We’ve looked at some economic analysis, not — I don’t know if anything has really been published on it,” said Red Rock Vice Chairman Lorenzo Fertitta on the company’s third-quarter earnings conference call last Thursday. “We think it could add somewhere in the neighborhood of about $200 million a year to the local economy here, which obviously we would benefit from.”

The Culinary Union, representing workers in the hospitality industry, endorsed Harris in the election and has shown its support for eliminating taxes on tips.

Certain experts argue that carrying out the removal of taxes on tips may be challenging enough that the policy fails to materialize. They mention concerns like a significant number of tipped employees belonging to low income levels, which means they aren't liable for much federal income tax initially, and the potential loss of revenue during a period of substantial deficits as reasons that could hinder the idea.

Considering the positive aspect of the situation — where the Trump Administration convinces Congress to eliminate taxes on tips — Red Rock might stand to gain significantly. Every gaming venue operated by the company is located in the Las Vegas Valley, which means that a significant portion of its loyal customers are hospitality employees from different establishments.

The $200 million amount referenced by Fertitta could have significant effects on the Las Vegas economy and would likely reach beyond just gaming. It might also aid Red Rock competitors like Boyd Gaming (NYSE: BYD) and Golden Entertainment (NASDAQ: GDEN), both of which manage gaming locations that, similar to Red Rock’s, are favored by Las Vegas residents.

“No tax on tips, I think would be a positive for our business,” said Red Rock President Scott Kreeger on the conference call.

If the no tax on tips policy is realized, it may provide Red Rock additional advantages in various aspects. Before the election, certain analysts predicted that the casino operator might reduce payroll costs by up to $3 million annually if tip taxes are eliminated.

During the conference call, CFO Stephen Cootey shared that view, pointing out that Red Rock could potentially save $2 million to $3 million each year in payroll costs if tips taxes are eliminated.

If that prediction holds true, competitors like Boyd and Golden might also experience advantages in payroll expenses.

There's some positive news from the NCAA, as the organization overseeing college sports states that occurrences of player abuse decreased during the M .. Read more

Following a one-year suspension for breaking the NFL's regulations regarding sports betting, Isaiah Rodgers, a 26-year-old cornerback with the Philade .. Read more

Operator of cryptocurrency casinos MyPrize announced on Tuesday that it has raised $13 million in two rounds of funding, increasing its enterprise val .. Read more

© TheRealGamble, 2026. All rights reserved