Fitch Ratings reaffirmed Las Vegas Sands’ (NYSE: LVS) credit rating at “BBB-,” which is the lowest level of investment-grade rating, and assigned a “stable” outlook.

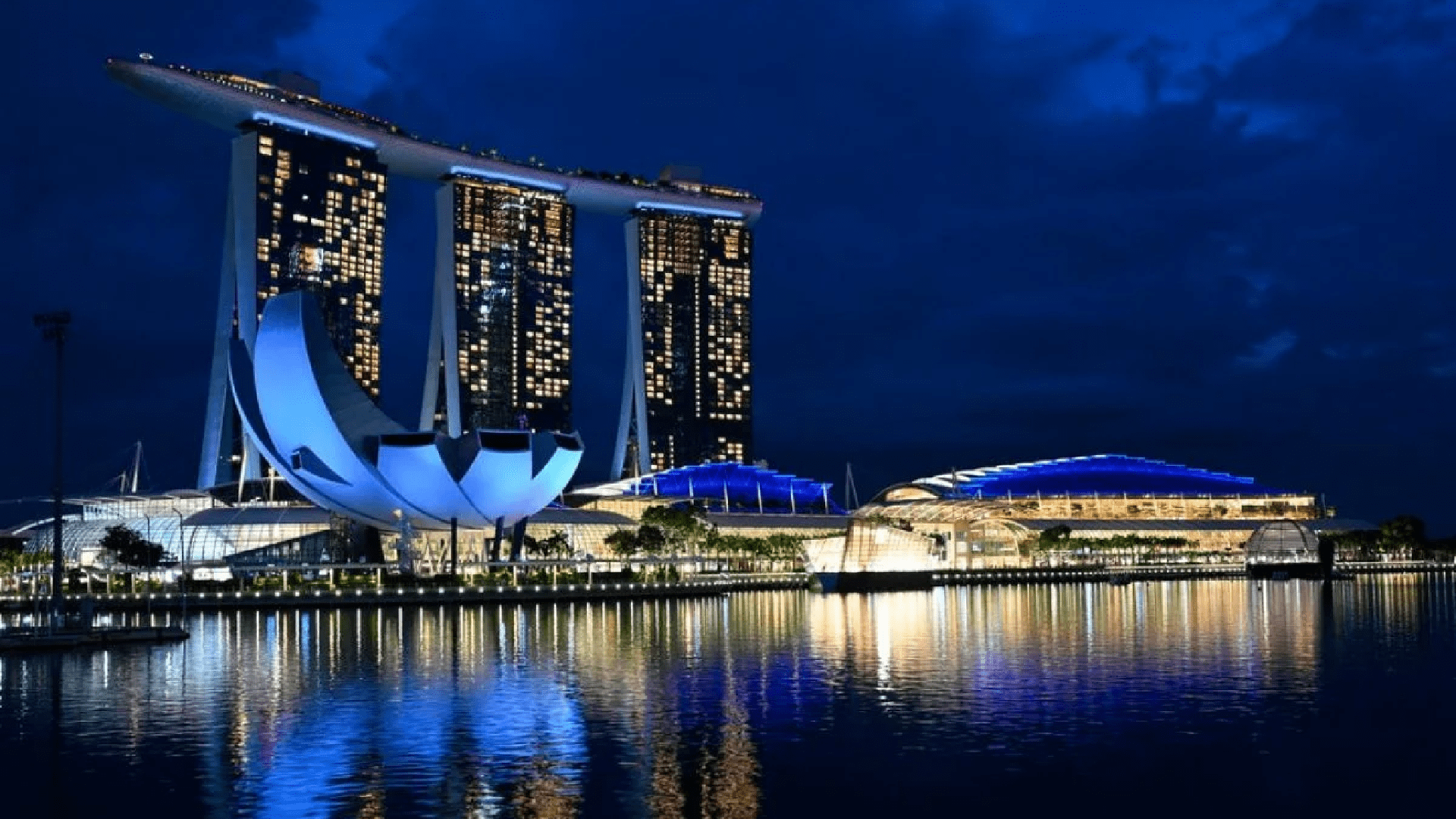

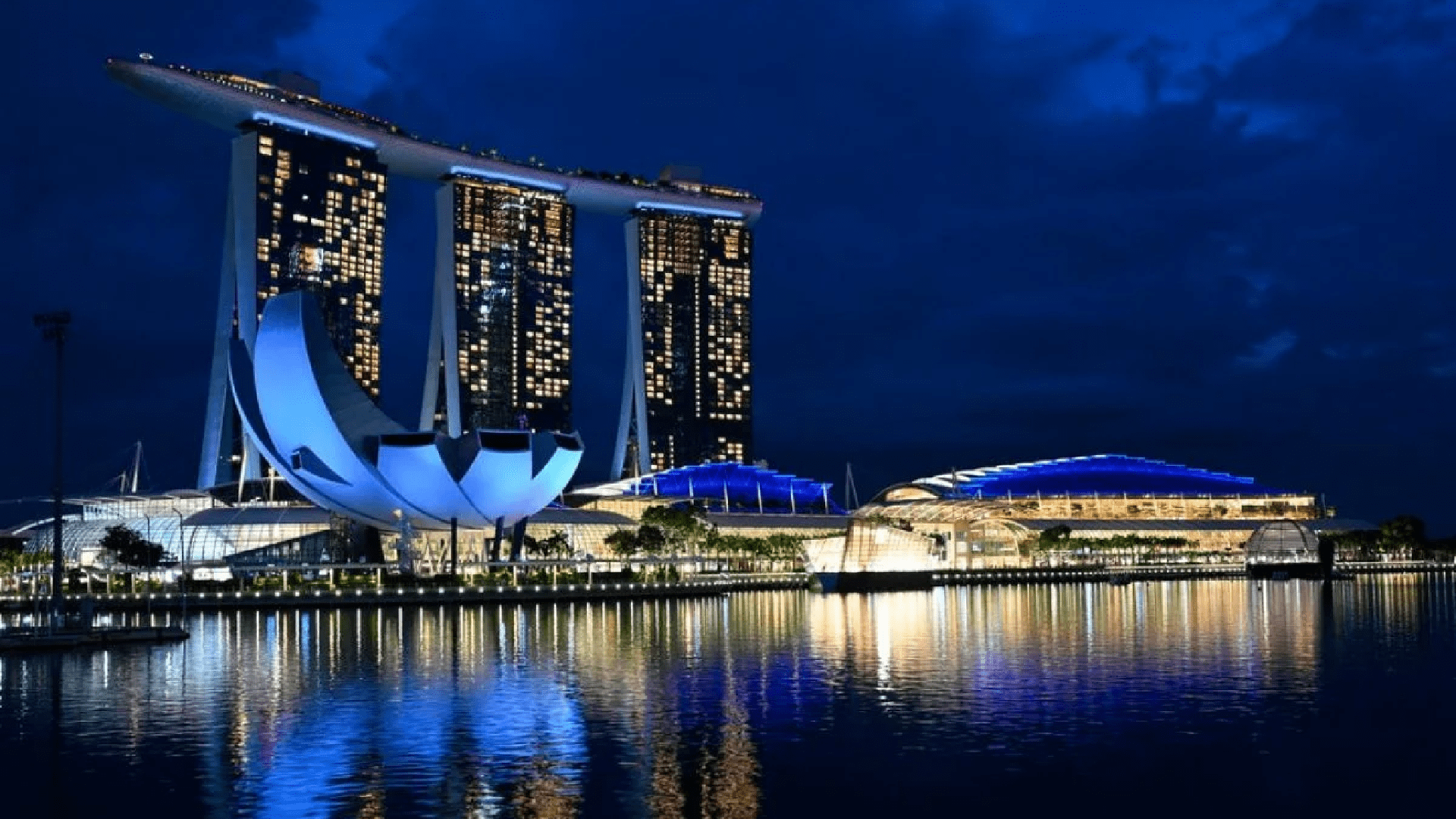

In a report released last Friday, the research firm highlighted the operator’s potential for free cash flow and the robustness of Marina Bay Sands in Singapore as reasons backing the investment-grade rating. Nonetheless, sluggishness in Macau, where Sands China operates five casino hotels, was noted as well.

"The company’s strengths include its scale, competitive positions, and robust free cash flow, offset by a heavy capital program and potential Chinese economic weakness,” said Fitch of Sands.

The operator is nearly two years past the restoration of its investment-grade ratings, which were downgraded to junk right at the beginning of the coronavirus pandemic. Sands' strong credit rating is backed by a positive earnings before interest, taxes, depreciation, and amortization (EBITDA) forecast, which enables the company to lower its leverage. Fitch upgraded Sands to investment grade in February 2024.

Fitch projected that Sands will have an earnings before interest, taxes, depreciation, and amortization (EBITDA) leverage of 3.5x, mentioning that “if leverage consistently drops below this threshold” a rating increase could occur.

“LVS’s liquidity is strong, with $4.2 billion in cash and significant credit facility availability. Key risks include sustained high leverage and liquidity deterioration,” adds Fitch.

Fitch analysts observed that the gaming firm has a longstanding history of being careful with its balance sheet management, which reinforces the higher quality credit rating and may set the stage for a future upgrade. Sands is recognized for effectively conveying leverage goals to investors.

The ratings agency remarked that although Sands is repurchasing its shares — which an analyst perceives as significantly undervalued — and intends to increase its dividend, the generation of free cash flow should be sufficient to back those rewards for shareholders. Fitch stated that the gaming firm possesses sufficient cash to handle Sands China’s upcoming debt obligations due this year.

In a demonstration of the operator’s financial reliability and capacity to secure funds, Sands has recently acquired $9 billion in financing for improvements and growth at Marina Bay Sands. This signifies one of the largest increases in corporate credit in Singapore's history.

Fitch indicated that elements indicating a possible upgrade “comprise enhanced leverage and greater geographical diversification.”

Sands presently operates six integrated resorts — five located in Macau and one at Marina Bay Sands. The way geographic diversification is achieved is yet to be determined, but that initiative mainly focuses on the operator securing a gaming license in the New York City region, Texas perhaps legalizing casino gaming, and a potential proposal for a resort casino in Thailand.

The Guardian has uncovered that UK Prime Minister Rishi Sunak's top aide placed a £100 ($US128) wager on a July election just days before the leader' .. Read more

A woman faces charges of child neglect after her baby was discovered alone in a stroller at the entrance of Florida’s Seminole Hard Rock Hotel and C .. Read more

Shares of Star Entertainment Group dropped to a new all-time low on Thursday as the Australian casino operator encounters a liquidity shortage and a c .. Read more

© TheRealGamble, 2026. All rights reserved